Your DERP Pension Benefit Payment

As a DERP retiree, you join more than 10,800 retirees who receive a lifetime monthly DERP Pension Benefit payment. Whether you’re wondering when to expect your payment, updating direct deposit information, or electing tax withholding, you’ll need to stay informed about topics related to your DERP Pension Benefit payment so you can manage your finances in retirement with ease. Below is a summary of information regarding your payment.

Your First DERP Pension Benefit Payment

Your first monthly DERP Pension Benefit payment is effective the first day of the month after you separate from employment as long as you submit your completed Retirement Application and all required documentation within 30 days following your separation date. Your DERP Pension Benefit payment is paid by direct deposit to your bank account or credit union on the first business day of each month.

If we receive your complete Retirement Application and all required documentation by the 15th of the month prior to your effective retirement date, you’ll receive your first benefit payment on the first business day of the month your retirement is effective.

If we receive your complete Retirement Application and all required documentation after the 15th of the month, you’ll receive your first DERP Pension Benefit payment combined with your second benefit payment on the first business day of the following month.

Direct Deposit

As a new retiree, you’ll receive your lifetime monthly DERP Pension Benefit payment through direct deposit. Your payment is deposited directly into your checking or savings account at your bank or credit union the first business day of the month. Direct deposit is fast, easy, and secure, and you have access to your funds without having to take a trip to the bank!

Log in to your MyDERP.org account and click the Direct Deposit button to set up or change your direct deposit.

Log in to your MyDERP.org account and click the Benefit Account button to view and print your direct deposit advice and review your DERP Pension Benefit history.

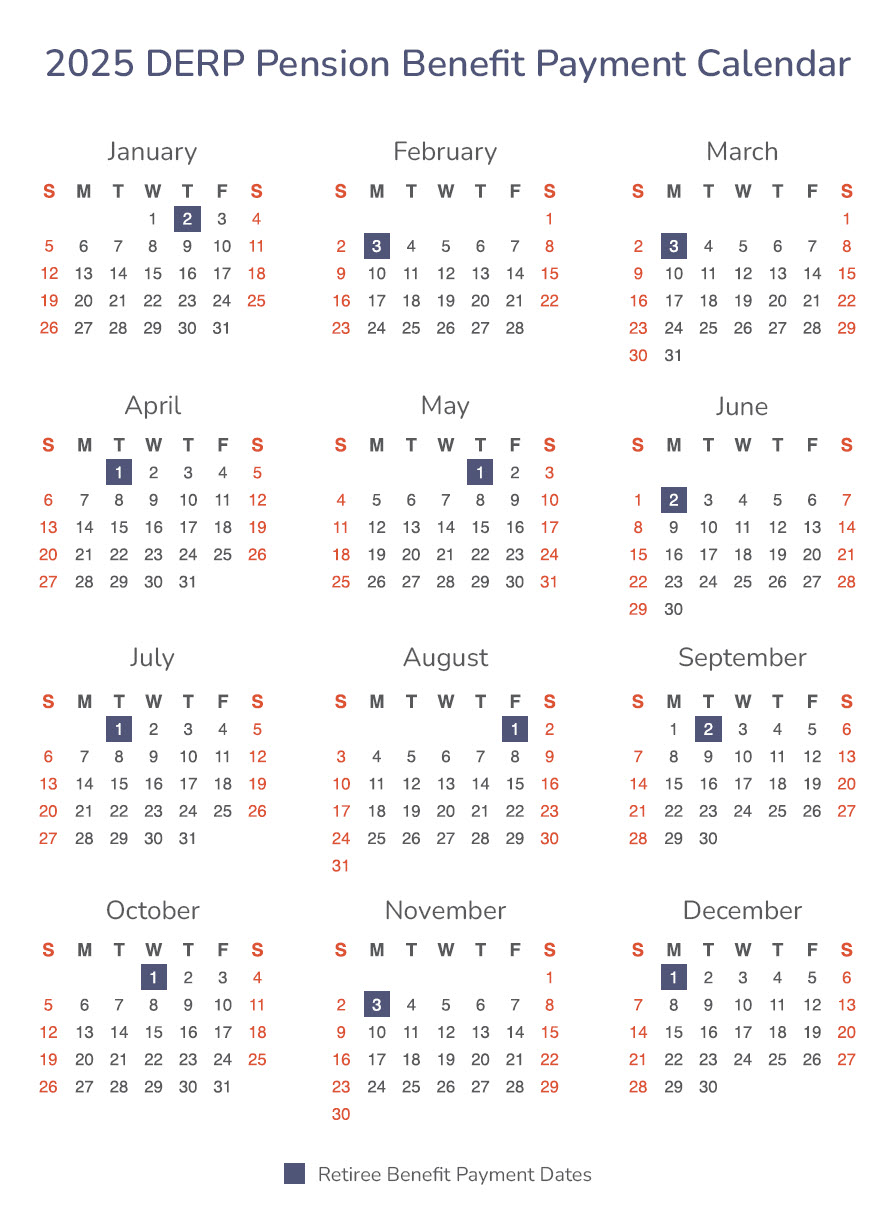

Payment Dates

Your lifetime monthly DERP Pension Benefit payment is paid by direct deposit on the first business day of the month. If you’ve been with us for a while and still receive a physical check, your check will be mailed on the first business day of the month. Payment dates are listed below.

Download the Pay Dates Calendar.

Download the Pay Dates Calendar.

Income Verification

During retirement there may be times when you need to show proof of your monthly DERP Pension Benefit payment amount. We’ll provide you an income verification letter upon request.

To request an income verification letter, email Help@DERP.org. We’ll process and mail or email an official letter within three business days of receipt.

Taxes in Retirement

Your DERP Pension Benefit is considered taxable income, subject to federal and state income tax, and reported to the IRS and state of Colorado. We can withhold federal and Colorado taxes from your DERP Pension Benefit payment if requested. We can’t withhold taxes for any other state.

Colorado Income Tax Exemptions

- For members under age 65, the state of Colorado exempts the first $20,000 of retirement income.

- For members age 65 or over, the state of Colorado exempts the first $24,000 of retirement income.

Tax Withholding

To set up or change your tax withholding elections, log in to your MyDERP.org account and click the Tax Withholding button.

- We will mail or make available your Form 1099-R – Distributions From Pensions, Annuities, Retirement or Prot-Sharing Plans, IRAs, Insurance Contracts, etc. by January 31 to report your distrinution of retirement benefits.

- Log in to your MyDERP.org account and click the View Tax Forms link to view and print a prior Form 1099-R. To request an older Form 1099-R, email Help@DERP.org.

We can’t provide tax counseling. Consult your personal tax advisor, the IRS, and/or the Colorado Department of Revenue for any tax-related questions.

Have you moved?

If you have recently moved or changed your address, make sure to update your address in your MyDERP.org account. Keep in mind, if you move from Colorado to another state and were having Colorado taxes withheld, these taxes will continue to be withheld until you change your tax withholding elections.

To update your address, log in to your MyDERP.org account and click the Address button.

1099-R Form

We’ll mail, or make available through your MyDERP.org account, your Form 1099-R – Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., by January 31 to report your distribution of retirement benefits.

We can’t provide tax counseling. Consult your personal tax advisor, the IRS, and/or the Colorado Department of Revenue for any tax-related questions.

Log in to your MyDERP.org account, click the View Tax Forms hyperlink to view and print a prior Form 1099-R. To request older Form 1099-R’s, email Help@DERP.org.

Some members will receive more than one 1099-R form in a sinlge tax year. This can happen for two reasons.

- You turned 59 1/2. Tax rules require us to report your payments differently before and after that age, so you’ll get two forms.

- You had two payee accounts.

Living Abroad

We cannot deposit your monthly DERP Pension Benefit payment into a foreign bank account. If you live or are planning to move abroad, it’s important to know your options and finalize your arrangements before you depart to avoid complications.

- Option 1 – We can mail a paper check to your address in your MyDERP.org account. You should verify your bank in the country you live will accept and cash your payment.

- Option 2 – You can receive your payment via an international wire transfer. With this option, you must verify your bank allows international wire transfers. Wire transfer fees and administration fees are deducted from your payment.

Federal Limits on Benefits

Internal Revenue Code (IRC) §415(b) sets limits on the retirement benefits that we can pay from the qualified trust. Most members are not affected because their DERP Pension Benefit payment will not exceed the §415(b) limits, however a few highly paid members may exceed the limits.

Although §415(b) imposes these limits, IRC §415(m) allows DERP to use a replacement benefit arrangement (RBA) to provide relief for a retiree who exceeds the 415(b) limit. If it’s determined your DERP Pension Benefit payments will exceed the §415(b) limits, a DERP Membership Services Representative will contact you to discuss what it may mean for you.

Cost of Living Adjustment (COLA)

When evaluating a possible COLA, the DERP Retirement Board takes into account the following factors:

- The DERP Retirement Board’s Primary Responsibility is to Safeguard the Overall Soundness of the Retirement Plan.

The retirement board’s top priority is to ensure funds are in place to pay every dollar of benefits promised to every current and future retiree. When contemplating a COLA, the retirement board assesses our unfunded pension liability, health insurance liability, and investment performance, among other things.

- The DERP Retirement Board Assesses the Impact a COLA Could Have on all DERP Members, Including Those in Different Tiers of Membership.

The retirement board considers the contribution rates for current employees compared to the contributions paid by retirees while employed. City employees did not contribute to their own retirement benefits until 2003, and employee contributions have steadily increased since that time. This means that for most current retirees, their monthly DERP Pension Benefit payment was funded, for the most part, by the city. Currently, every benefited employee contributes a percentage of each paycheck to DERP, along with a contribution from the city. Granting current retirees a COLA could increase the burden on current employees, who already pay a historically high contribution to DERP.

- Your DERP Pension Benefit Is Meant to Be One Part of Your Retirement.

While working at the city you were fortunate to be part of a retirement plan that guaranteed you a monthly payment upon your retirement. When you were employed at the city, you also paid into Social Security which means you receive a Social Security Benefit in addition to your DERP Pension Benefit. The Social Security Administration reviews Social Security benefits annually and adjusts for inflation based on a defined formula. The Revised Municipal Code of the City and County of Denver, which governs DERP, does not have a mandatory inflation adjustment or COLA formula.